Functional balance sheet for financial and accounting analysis: definition, example and Excel template

It shows in one place how much the business owns (assets) and owes (liabilities). The report is used by business owners, investors, creditors and shareholders. It lets you see a snapshot of your business on a given date, typically month or year-end.

C. Profitability Ratios

Generally, sales growth, whether rapid or slow, dictates a larger asset base—higher levels of inventory, receivables, and fixed assets (plant, property, and equipment, or PPE). As a company’s assets grow, its liabilities and/or equity also tend to grow in order for its financial position to stay in balance. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company. Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business.

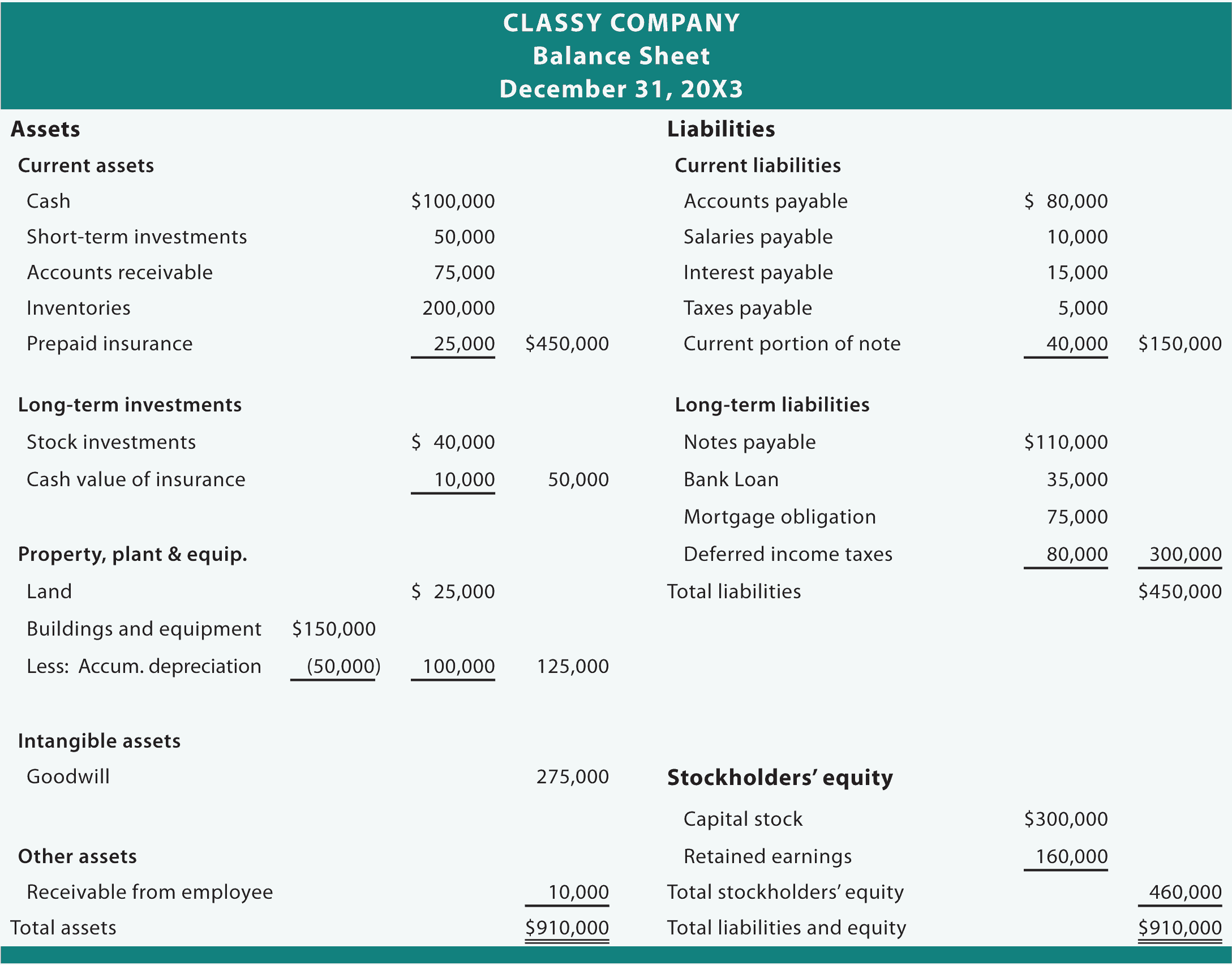

Account Format Balance Sheet

Investors, analysts, and potential creditors leverage these statements to understand how a company generates and allocates its funds. For example, if a company has a lot of cash, low debt, and solid retained earnings, it suggests it’s financially stable and can handle unexpected challenges. On the other hand, excessive debt or declining asset values may be a sign of financial trouble. Understanding a company’s financial health helps us make better decisions about investing, lending, or partnering with it.

Create a Free Account and Ask Any Financial Question

This is the perfect template for short-term analysis of fiscal health but can be used for year-over-year monthly and quarterly comparisons. According to the historical cost principle, all assets, with the exception of some intangible assets, are reported on the balance sheet at their purchase price. In other words, they are listed on the report for the same amount of money the company paid for them.

B. Trend Analysis

The Balance Sheet and Profit and Loss Statement are essential reports for understanding your business’s financial health. You should review these reports regularly to ensure your company is financially stable. By examining the balance sheet, stakeholders can assess the company’s financial well-being, make informed choices, and evaluate its capacity to meet obligations and generate profits. Similarly, putting a specific value on intangible assets like brand value or intellectual property can be subjective and tough to determine. So, the balance sheet may not give you the full picture of what those assets are worth.

Liabilities

In financial reporting, the terms “current” and “non-current” are synonymous with the terms “short-term” and “long-term,” respectively, and are used interchangeably. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property what is the difference between deferred revenue and unearned revenue costs, expenses, rental and taxable income, selling costs, and capital gains. Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase. You can also edit the template to include whatever details you need to provide for renting, refinancing, home-equity lines, and possible eventual sale of your investment property.

These statements break down cash movements into investing, financing, and operating activities. Cash flow and income statements are also pivotal in corporate finance and accounting. For example, if a company’s debt-to-equity ratio is much higher than the industry average, it may suggest higher financial risk or reliance on debt. Understanding industry benchmarks provides context and helps you evaluate a company’s financial position more effectively. However, a weak balance sheet, high debt levels, or deteriorating financial ratios may raise concerns and affect borrowing costs. Creditors can use the Statement of Financial Position information to make informed decisions about lending terms and interest rates.

- It’s wise to have a buffer between your current assets and liabilities to at least cover your short-term financial obligations.

- Under this method, the assets are arranged in the order of liquidity & the liabilities are arranged in the order of permanency.

- The balance sheet for a small privately held business may be prepared by the owner or a company bookkeeper.

- Not only does it help in tracking the value and condition of your assets over time, but it also plays a vital role in financial management, ensuring accurate depreciation calculations.

- This shows how much of the company belongs to its shareholders or owners.

Current and non-current assets should both be subtotaled, and then totaled together. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. As you can see, the report format is a little bit easier to read and understand. Let’s look at each of the balance sheet accounts and how they are reported. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet.

The balance sheet does not “balance”—the financial model contains an error in all likelihood. The two funding sources available for companies are liabilities and shareholders’ equity, which reflect how the resources were purchased. If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward.